The BlueWater Capital Fund promotes responsible investments and integrates ESG factors into investment analysis, supporting Portuguese SMEs.

Focusing on the areas of Sustainability, Water & Energy and CleanTech.

It is intended to be a commitment that favors results, the adoption of good sustainable and competitive practices, the relationship with stakeholders, the general public and the environment.

Acquire participation units that allow you to submit an application to the Portuguese Golden Visa system.

Investment Policy

Geografia

Investments in Portugal:Between 60% and 100% of the Fund's capital

Sustainability Promotion

Fund Promotes Sustainable Investments

Golden Visa

Investment in the Fund is eligible for Golden Visa applicationWith the aim of boosting technological advancement and promoting economic growth, supporting innovative Portuguese SMEs.

SECTORS AND ACTIVITIES

Circular economyWater and Energy

Food Production

Recycling

Tecnologia Verde

Health

STAGES

Seed - 10% a 30%Start-up- 25% a 50%

Early Stage - 20% a 40%

Expansion Stage - 5% a 20%

INVESTMENT

% Equity% Convertible Loans

% Acquisition of equity participations among other forms of financing

The Fund's Portfolio will be composed of companies operating in different areas of activities and sectors.

Risk reduction is achieved through a harmonious choice of various investment stages, different activities and sectors, maintaining the common thread of promoting sustainability.

The investment policy identifies the following areas of activity:

Risk reduction is achieved through a harmonious choice of various investment stages, different activities and sectors, maintaining the common thread of promoting sustainability.

The investment policy identifies the following areas of activity:

Circular economy

Innovative and impactful projects that combine recycling with the production of new materials and energy efficiency.

Energy

New solutions to maximize energy efficiency.

Water

Use and treatment of water in all aspects.

Technology applied to sustainability

Knowledge-based products or services that improve operational performance, productivity, or efficiency while reducing costs, consumption, energy consumption, waste, or pollution.

Biotechnology

Projects in the field of science to develop sustainable and environmentally friendly solutions, with positive impacts on water and soils.

Healthy Eating

Producing food in a way that protects the environment, makes efficient use of natural resources, and improves conditions for the parties involved.

Recycling

Projects that promote the circular economy and control in reducing environmental impact.

ESG Framework

The Fund promotes environmental and social characteristics, or a combination of these characteristics, and the companies where the investments are made respect Good Governance practices.The Fund thus falls within the scope of article 8 of Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019.

For more information, we suggest reading the Fund Sustainability Briefing Paper.

Fund Features

Target Size: 40.000.000€

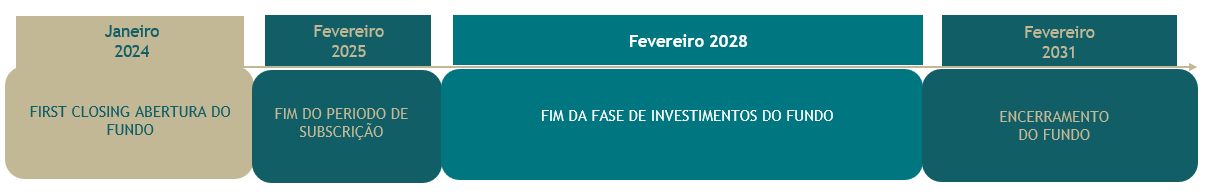

Maturity: 8 years (2031)

Minimum subscription:

Participation units A = 200.000€ ;

Participation units B = 50.000€

B units with a preferred dividend of 5% per year

Calendar